A bucketwheel operation, the Bogatyr mine in Kazakhstan produces approximately 50 million mtpy.

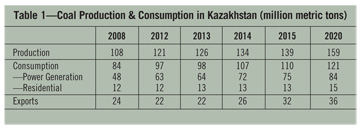

Kazakhstan has steadily increased coal production levels in recent years to satisfy growing demand. In terms of production, the country occupies eighth place. The mines currently produce a little more than 120 million metric tons per year (mtpy) of which 97 million mt are consumed domestically and 22 million mt are exported. Kazakhstan has 4% of known world reserves and these reserves are concentrated in 16 main deposits in three coal basins.

Among the countries of the Common-wealth of Independent States (CIS), Kazakhstan occupies third place in terms of largest reserves and first place in terms of coal production per capita. At present, the coal industry provides 78% of the electricity in the Republic of Kazakhstan, almost 100% of coke production and it fully meets the needs of the domestic sector (home heating).

For the foreseeable future, the experts at the Republican Association of Mining and Metallurgical Enterprises predict that with the current level of development, coal will remain the fuel of choice for the electric power industry. According to the association, the volume of consumption from year-to-year will only rise. As a result, it is projected that coal consumption will grow to 121.3 million mtpy by 2020 and production will have to grow to more than 158 million mtpy to support this level of demand.

Increasing production by 25% over the course of seven years is a tall order for the region. It is feared that development of the industry will probably not keep pace with future demand. Approved in 2008, the long-term program of coal industry development until 2020 has been canceled. By the beginning of 2014, Kazakhstan could adopt a new, more complex long-term strategy to grow future power generation levels that involves the use of renewable resources.

Recently, mining and the use of coal has been identified as harmful to nature, so Kazakhstan President Nursultan Nazarbayev has instructed the government to develop a plan through 2050 that would result in at least 50% of the country’s electricity being generated from renewable resources.

This decision raises more questions than it answers. The coal industry could lose a significant part of its originally planned investment for coming years if the government follows the directive. Energy experts point out that Kazakhstan’s long-term prospects are very much unclear. However, government officials claim that all investment projects in the area announced so far will not be canceled. Moreover, coal production could be transferred to the export market after 2020 if there is excess capacity.

For Now, Coal Production & Consumption Will Only Grow

While researching the data for the 2008 program, the government estimated Kazakhstan’s total bituminous coal reserves to be more than 15 billion mt. Balance reserves of the category A, B, C1 and C2 amounted to 33.6 billion mt, 21.3 billion mt were anthracite and 12.3 billion mt were brown coal (lignite). Off-balance sheet reserves of coal basins and deposits were estimated to be more than 28.6 billion mt, including 3.2 billion mt anthracite and 24.5 billion mt of brown coal.

Most of the estimated reserves are anthracite reserves from Karaganda, Ekibastuz and Tengiz-Korzhankolskogo basins. The rest is brown coal, concentrated mainly in Maikuben basins. The truth is, by now the whole economy of Kazakhstan is highly dependent on coal mining. So, even with the new goals set by the president, the government could change these prospects somehow.

At an extended board meeting in February, Minister of Industry and New Technologies Asset Issekeshev appealed to the government with a proposal to include a new plan of development for the coal industry as far as power generation. He believes coal will remain as the primary fuel source until 2030, at least.

“It should be noted that today, the coal industry provides 74% of the production of the electricity produced in Kazakhstan,” said Issekeshev. “By 2030, the share of electricity from coal-fired power plants will still be 75%. From 2020, coal mining will begin in the Turgay basin, which will boost the level of mining by 10 million mtpy. Projected volume of mining by 2030 will be 155 million mt. The total investment in the coal industry over the next decade will amount to $4 billion.”

At present, coal is mined in the Karaganda, Ekibastuz and Maykubinsky, basins, as well as Kushokinskoe, Borlinskoe, Shubarkol, Karazhyrinskoe fields and several small deposits in different regions of Kazakhstan, where the small amounts of coal are mined for local needs. Thus, a large part of the reserves are concentrated in central Karaganda, Pavlodar and Kostanai.

The Kazakhstan government considers increasing coal exports to be very important. The representatives of the Ministry of Energy recently reported that by 2015 the country should boost the level of export to 32 million mt, almost by 10 million mt more than current levels. Kazakhstan would be selling coal in a region that is competitively dominated by Russian coal companies.

Coal Mining is Highly Consolidated

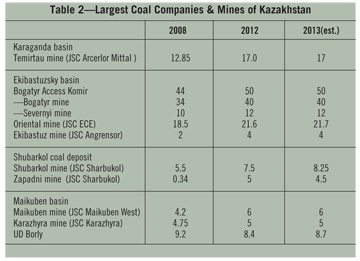

There are 33 companies currently mining coal in Kazakhstan, the largest of which are: LLP Bogatyr Access Komir, JSC ECE, JSC Shubarkol, Company Borly (belonging to the copper mining group Kazakhmys), LLP Maikuben West and JSC ArcerlorMittal Temirtau. Most of them (with the exception of Bogatyr Accesss Komir) are mining coal for coal-fired power plants or steel mills owned by large multinational companies. They account for more that 90% of the total coal mining in the country.

Bogatyr Access Komir owns the Bogatyr mine near the Ekibastuz in the Pavlodar province. With an output of 56.8 million mt of coal in 1985, the Bogatyr mine entered the Guinness Book of World Records for being the world’s largest single coal mine. Since then, this level of production has not been sustained, and in 2012, the production of the mine was 40 million mt of coal. Together with the neighboring Severnyi mine, the oldest mine in the Ekibastuz coal basin, they hold reserves estimated at 4.5 billion mt, which at current production rates would give them a mine life of more than 100 years.

Coking Coal Will be Developed Mostly Rapidly

Meanwhile, the demand for coking coal during the coming years will rise very rapidly. By 2020, Kazakhstan could be producing 27 million mt compared to the current 16-million-mt level. As of now, there are only two companies producing great amounts of coking coal, ArcelorMittal (Temirtau mine) and the Association Hephaestus, both located in the Karaganda coal basin. The Temirtau, which annually produced about 16 to 17 million mt of coal dominates the market. A recent statement by ArcerloMittal said that production from Temirtau will not likely increase. With a recovery in demand for coking coal from metallurgical plants in the Russian Federation, production from the Karaganda basin could rise as high as 25-27 million mtpy by 2020.

To solve this problem, several new mines are on the drawing board: Dolinskaya-Oblique, Abai-Oblique and Tentekskaya Dubovskaja, which should be launched after 2013. Together these three mines will boost the level of mining of coking coal by 6.3 million mtpy. They have all been implemented in the form of private-public partnerships with the strong financial support of the state. At the same time, the Association Hephaestus forecast the rise in the level of production from 2.35 million mt in 2015 to 6 million mt in 2020. The level of coking coal mining will grow more rapidly than the level of mining in the coal industry in general.

At the same time, the mining of coking coal will be characterized by the steadily growing level of efficiency — at least in the case of the already operating producers.

Future Investment

Currently all of the large coal miners of Kazakhstan have plans for further investments and business development in coming years. In particular, Bogatyr Access Komir continues to re-equip all of its production facilities. The company has allocated funds to purchase new equipment. It almost prepared the transition to the new auto-conveyor technology for its main production assets. This project is supported by the state and it will increase the capacity of the Bogatyr mine from 42 million mtpy of coal to 50 million mtpy in 2015.

In addition to new hydraulic shovels and haul trucks, the Bogatyr mine will also see new crushers, conveyors, a blending system with the warehouse with the designed capacity of nearly a 600,000-mt loading complex, which will provide a reduction in the turnover of cars by three times, from the current 15 hours to 5 hours. In total, the modernization of the largest mine in the country will cost nearly KZT 45bn ($29 million).

Using market pacts with Russia, Belarus and Kazakhstan, Bogatyr Access Komir will gain more opportunities to supply coal to the Russian market.“We have full clarity on the prospects for the coal industry in Kazakhstan to 2020 and the development of our company until 2017,” said Victor Schukin, CEO Bogatyr. “Today we eye an important task, the modernization of mining operations and the construction of the internal dump. At the same time we need to keep the current level of costs for coal production low and achieve a significant increase in labor productivity in the foreseeable future. Until 2017, it should not be an additional cost of work, so without the unnecessary investment, we could keep not very high prices for our products.”

Substituting Renewables

With a new energy doctrine oriented toward renewable energy resources currently under government consideration, the situation may change and the Kazakhstan coal industry could lose ground in the long-term outlook.

According to official statistics, at present, 75% of the country’s electricity is produced by coal-fired power stations. Gas accounts for 11%. Hydroelectricity provides 10%. Wind and solar combined provide less than 0.5%. “If we consider the strong investment and the scientific approach to all three of these types of energy, it is quite possible that we will be able to increase their share in the structure of total electricity generation in the country to 13% in coming years,” Issekeshev said.

According to official statistics, at present, 75% of the country’s electricity is produced by coal-fired power stations. Gas accounts for 11%. Hydroelectricity provides 10%. Wind and solar combined provide less than 0.5%. “If we consider the strong investment and the scientific approach to all three of these types of energy, it is quite possible that we will be able to increase their share in the structure of total electricity generation in the country to 13% in coming years,” Issekeshev said.

It is not clear when the “coming years” will come, but it is obvious that energy from renewable sources will be used to replace energy from coal domestically. Currently all largest producers and industry experts say that coal miners in Kazakhstan have nothing to fear until 2020, and by then attitudes about power and renewable fuels versus coal may change.