Coal operators in the Powder River Basin, such as Peabody’s North Antelope Rochelle mine (above), could experience a rally with stockpiles dwindling among utilities (Photo courtesy of Peabody Energy).

According to preliminary stats compiled from the Mine Safety Health Administration (MSHA), Powder River Basin (PRB) production roared back 27 million tons from 62 million tons in the second quarter to 89 million tons during the third quarter of 2016. On an annualized basis, third-quarter 2016 production equates to 356 million tons produced or 107 million tons higher than the annualized second-quarter 2016 totals. However, compared to third-quarter 2015 annualized results, third-quarter 2016 production was still 67 million tons lower than a year ago.

PRB production may actually be higher during the third quarter of 2016. Western Fuels’ Dry Fork mine reported 3.1 million tons of production during Q3 2016, which is more than double what was reported during the second quarter of 2016. However, we believe this is a reporting mistake. Until further notice, we have assumed Dry Fork’s third-quarter 2016 production is half of what was reported by MSHA.

Full-year 2015 PRB production was 398 million tons. For 2016, Hanou Energy believes when the final numbers are in, the PRB will produce around 311 million tons. The increase is mainly attributed to higher natural gas prices and the record high hot summer, which increased PRB demand in its “niche” market. Year 2008 was the record PRB production year when 496 million tons were produced.

With natural gas prices increasing to around $3/mmBtu, Hanou Energy correctly predicted in its second-quarter 2016 PRB update that PRB demand would increase in its “niche” market, that stocks would drop and that PRB spot prices would increase throughout the remainder of 2016 and into 2017.

Currently, the Energy Information Administration (EIA) reported that subbituminous stockpiles dropped from a record high of 108 million tons at the end of April 2016 to 93 million tons at the end of July. Hanou Energy believes when additional figures are published, subbituminous stocks will probably drop to around 80 million tons by the end of October.

The good news for producers: PRB 8,800 Btu spot prices increased from $9.25/ton in May to $12.25/ton during September. With the power plant “off” season beginning in October, prices have retreated by $0.50/ton since then.

Hanou Energy still contends that a strong price recovery could happen as early as spring 2017. Watch the monthly stockpile levels as reported by the EIA closely. Assuming we have a normal winter and $3/mmBtu gas prices, stocks should continue to drop throughout the winter. Maybe the magic 50-million-ton number will happen sooner rather than later.

There’s more goodt news. Bituminous stocks for electricity generation have dropped from a high of 84 million tons at the end of May to 73 million tons at the end of July, the last month reported by the EIA. With the export market heating up and with $3/mmBtu gas prices, Hanou Energy estimates at the end of October bituminous stocks will have dropped to 63 million tons. By the end of winter, bituminous stocks could drop to that magic number of 50 million tons. If so, prices should increase substantially for bituminous coal, and, as it has in the past, increase PRB demand and prices.

What about the Producers?

Alpha Natural Resources (i.e. Contura Energy), Arch Coal and Peabody Energy have exited or will soon exit Chapter 11.

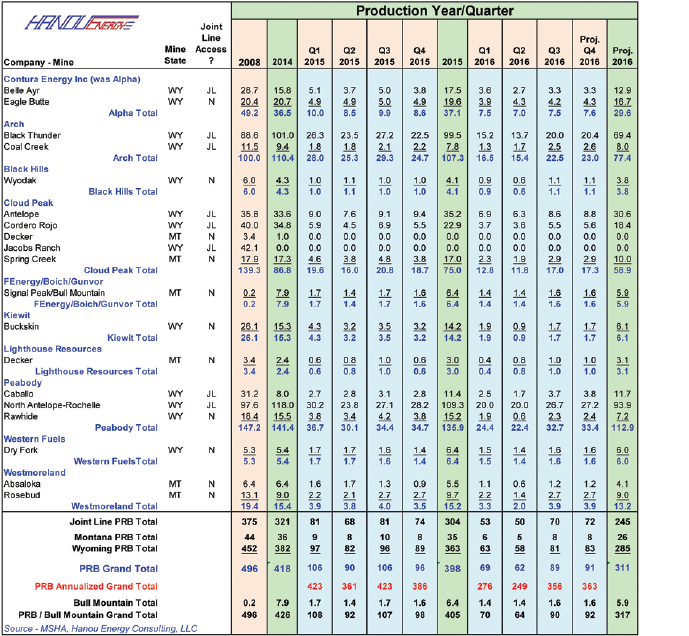

All PRB coal producers experienced higher production numbers from the second quarter to the third quarter of 2016. The biggest production increases occurred at Peabody’s, Arch’s and Cloud Peak’s mines. Respectively, Peabody, Arch and Cloud Peak produced 10.3, 7.1 and 5.2 million tons more from the second quarter to the third quarter of 2016.

Switching over to the Bull Mountain coalfield in Montana, the Signal Peak Bull Mountain mine production increased by 0.2 million tons from quarter to quarter. With the export market showing some life, Signal Peak’s production will be around 5.9 million tons in 2016 or 0.5 million tons lower than 2015.

The following table shows PRB and Bull Mountain coalfield production by company and by mine as reported by MSHA for the period 2008 through the third quarter of 2016 and our projections for full-year 2016.

Hanou Energy and Burnham Coal are updating their strategic study on the PRB. Available in August, their Powder River Basin Coal Supply, Demand and Price Trends 2016-2035 study is regarded as one of the best analyses of the basin available. Hanou Energy Consulting LLC is owned and operated by John Hanou. Hanou can be reached by phone at 410-279-3818 or via email at jthanou@hanouenergy.com. His website is http://hanouenergy.com. Burnham Coal LLC is owned and operated by Bob Burnham. Burnham can be reached at 303-517-7826 or by email at bob@burnhamcoal.com. His website is http://ijburnhamcoal.com.

Table 1 — Powder River/Bull Mountain Production, 2008-2015, Q1-Q3 2016, Q4 Projected by Company (millions of short tons)